“Ensure that the government understands the urgency ... and creates programs that can be enacted quickly ... or we will lose a generation of early stage businesses. The "valley of death" is now the Grand Canyon.”

Foresight recently partnered with a number of organizations, including Alberta Cleantech Industry Association, Canada Cleantech, Centre for Social Innovation, Ecotech Quebec, Newfoundland and Labrador Environmental Industry Association, the Maritimes Energy Association, Ontario Cleantech Industry Association, and the CORE Cleantech Cluster to conduct a nation-wide survey on the impact of the COVID-19 pandemic on the cleantech industry in Canada. What follows is a summary of the results, including conclusions and recommendations.

Executive Summary

The public health emergency caused by the Covid-19 pandemic is causing a liquidity crisis in the Canadian clean technology sector. This is being experienced as a loss of deal-flow and access to private sector debt and equity capital. It is translating into shutdowns for pre-revenue companies and into layoffs and scaling back in pre-commercial to commercial stage small and medium enterprises across the country. This is a significant short-term economic risk. Statistics Canada estimates that 282,045 jobs were attributable to total environmental and clean technology activity in 2017, or 1.6% of jobs in Canada.

This crisis also endangers the long term economic recovery process. As part of Canada’s Economic Strategy Tables Innovation, Science and Economic Development (ISED) Canada stated that its goal is to make cleantech one of Canada’s top five exporting industries with a targeted value of $20 billion annually. This goal is now all the more critical. A collapse in Canadian cleantech would also put Canada’s climate commitments and prospects for an accelerated energy transition at risk. In nominal terms, the value of environmental and clean technology activities totalled $61.9 billion in 2017, and accounted for 3.1% of Canadian GDP.

To continue to support the stabilization of this sector our cleantech survey and analysis results show:

The #1 need is liquidity to bridge this period of slow revenue and/or collapse of the planned financing options. Prefunding is preferred over reimbursement given the sudden nature of the liquidity challenges being experienced.

This is best delivered by expediting existing funding pipelines using SRED and NRC-IRAP, replacing lost private sector liquidity by giving direct grants, zero or low interest loans, and by delaying government finances such as deferring payroll taxes and increasing payroll subsidies.

- 79% of respondents need immediate financial and sales support.

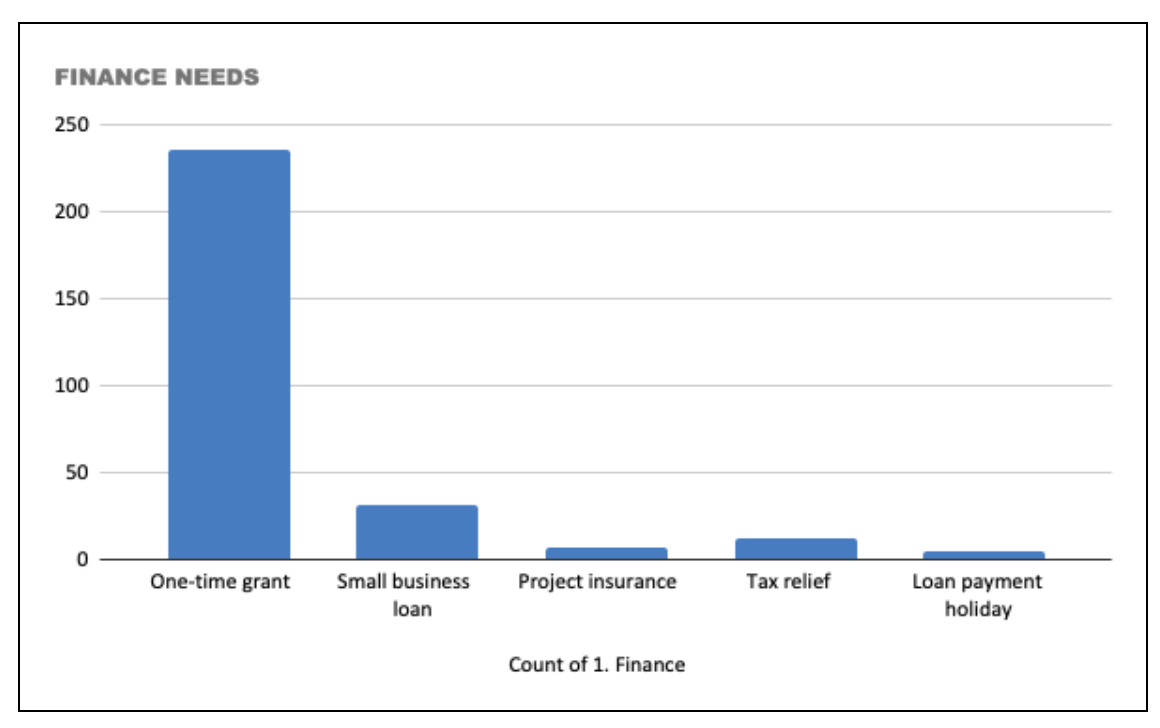

- 80% feel the simplest solution is a one-time grant. Funds will be used to retain staff, replace lost sales and delayed financing, and support ongoing R&D.

- 75% request additional payroll tax relief.

- 60% request streamlined access to government purchasing orders (i.e. SBIR type 1-3% SME earmark for all >$10M gov’t procurement; accelerate any existing contracts).

Analysis

The cleantech industry is rapidly growing across Canada. There are hundreds of promising, innovative companies that are generating jobs, revenue, and attracting overseas investment. They all share the vision of a green future economy. With COVID-19 many companies are experiencing the devastating impacts from cancellations of major industry events, job losses, and withdrawal of deal flow and financing opportunities.

In response to the impact of COVID-19 on cleantech companies in Canada, Foresight Cleantech Accelerator convened a group of cleantech accelerators and associations. ACTia, Canada Cleantech Alliance, Climate Ventures (an initiative of the Centre for Social Innovation), Ecotech Quebec, OCTIA, NEIA and the Maritimes Energy Association are now working together.

The group is collecting data through short coordinated surveys to understand immediate and short term needs. The purpose of collecting this data is to provide insights to all levels of government on how best to support companies with existing programs and funding during this disruptive economic period.

This is the second edition of a report showcasing the scale of the challenge for cleantech SMEs. The first report - shared on 20th March - conveyed data from 118 companies primarily from Western Canada. Since then partners have worked together to gather 168% more respondents from additional regions. 316 companies from Alberta, British Columbia, the Maritimes, Ontario, and Quebec have now responded. The results have shifted, but not significantly.

Companies are ever more concerned about sales and cash flow. They are bullish on one-time grants to support staff retention and waivers for existing grant obligations. It is critical to continue to support and stabilize this sector, and not lose the opportunities these companies can bring in helping Canada transition to a sustainable economy in the long-term.

In interviews with companies it was expressed that a one-time grant of $250,000 - 300,000 would see them through 4 months. For larger firms more would be required. Stacking rules need to be waived. Access to capital through BDC and EDC working with commercial banks needs to be made less restrictive and more flexible to be impactful in the cleantech sector.

In addition, cashflow is a major problem. Having buyers for technology was highlighted as essential. Government could take on a stronger role for procuring and purchasing cleantech or creating incentives for domestic industry to purchase, especially during this period when export markets are tight.

Demographics

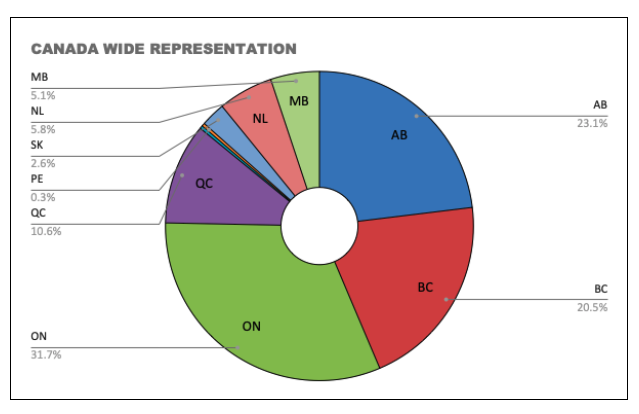

316 companies from across Canada completed the survey, with a higher concentration from British Columbia, Alberta and Ontario.

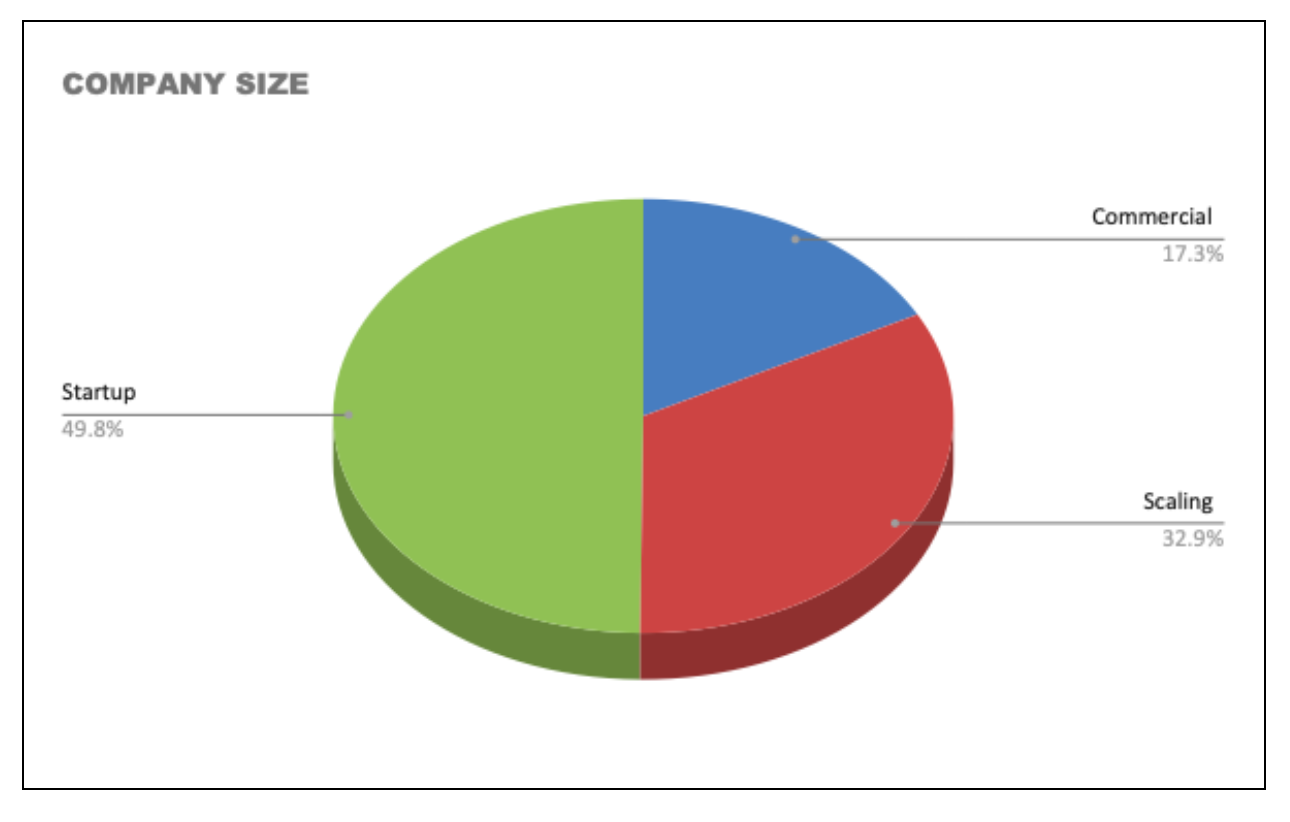

Of these companies, just under 50% identified as start-ups and the rest as scaling and commercial. This suggests that the survey respondents range across technology readiness levels (TRLs), commercialization stage and revenue.

Detailed Results

What part of your business needs the most help right now?

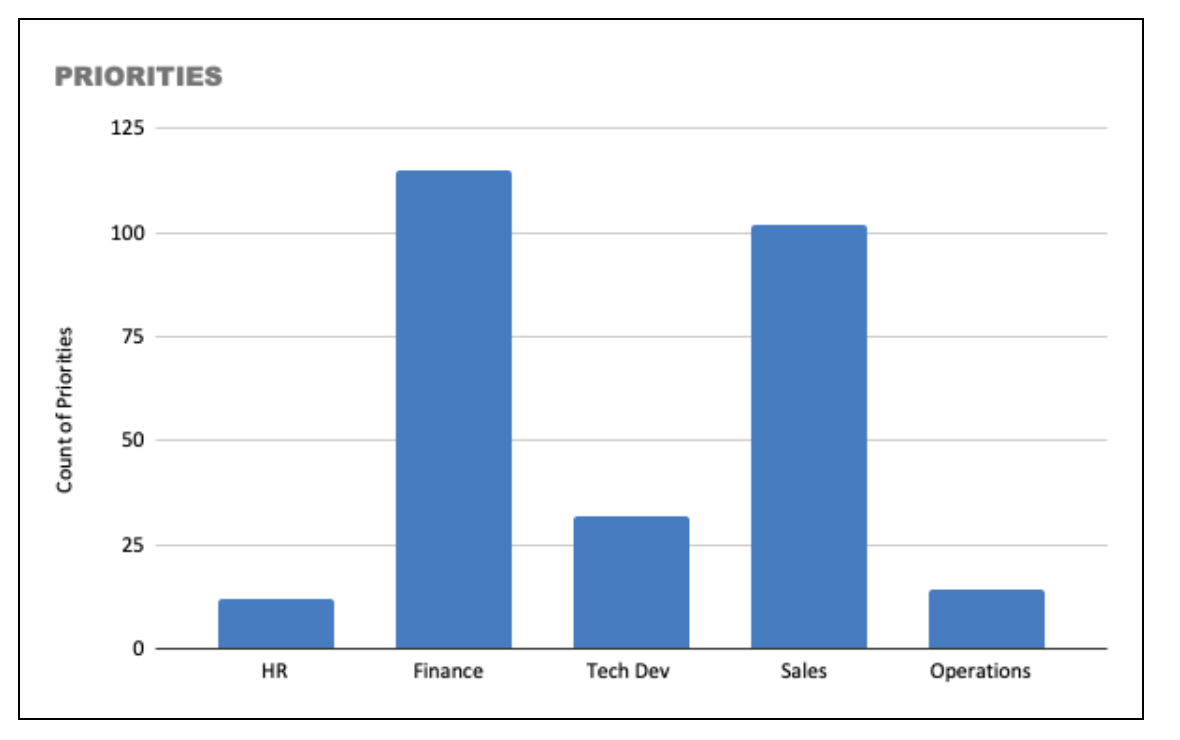

In response to the question, what part of your business needs the most help right now? A total of 277 companies (not all surveys had this as an obligatory question) responded and the majority of companies chose financing (42%), sales (37%) and technology and technology development (11.6%).

Financial Impact

Finance is the highest priority for companies. With our follow-up question for what are your immediate finance needs, we found that the majority (80%) of companies are looking for a one-time grant.

In the anecdotal evidence collected through the survey (in the comment box) and through follow-up calls, a number of major areas were identified as why there was a need for one-time grants:

- To pay and more critically retain their staff during this interim period

- To bridge them through a critical period as they are going through technology R&D

- To bridge them through a critical period in financing which is being delayed

- To bridge them through a slowdown in sales growth (as they are scaling and extremely sensitive to declining sales)

The earlier stage pre-revenue startups that are either mid-raise or at a point of needing to raise dollars soon are being directly impacted. We found that as a result of COVID-19, these deals are falling through or will fail to materialize in time. If this is not remedied soon, the long-term impacts of this will be loss of revenue, shortage of investment and lay-offs.

“Support would best be achieved through a pool of funding opportunities or introductions to private funding that is available during this hard economic time. We are already seeing reduced contact with investors and some are backing away due to the poor markets.”

For later stage companies, we found the impact of COVID-19 can also lead to fundraising challenges resulting short-to-medium term impacts:

“Company X are fairly stable at the moment, but have staffed up in anticipation of series B later this year which will become more difficult. If signs are that they will miss revenue targets, and financing will not be available later, they will look at salary caps and layoffs in 30-60 days time.”

For the companies that are more established and in the commercial category, we found that their revenues are rapidly declining as a result of domestic and export markets hit by Covid-19. This is having a direct impact on jobs.

"Company X has already laid off one third of their staff, and expect to lose another 15-20%. To bridge them over the next 4 months, they need $300,000."

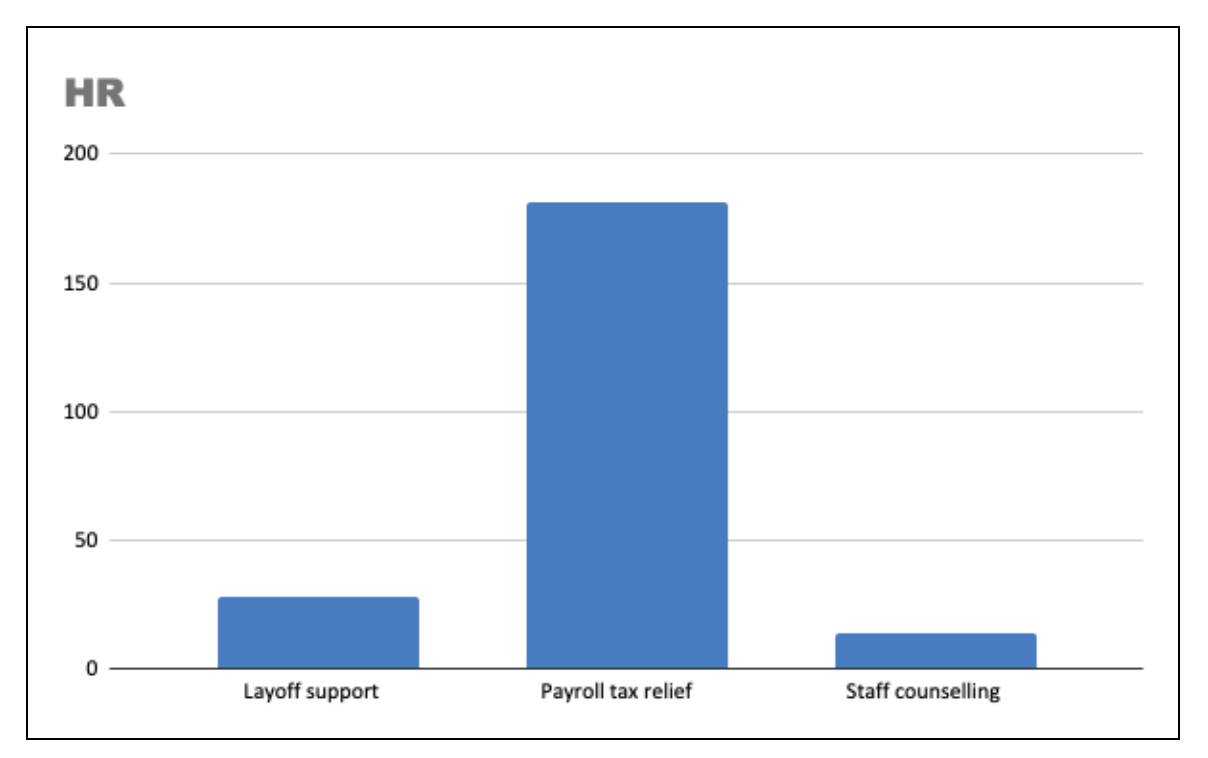

To alleviate the pressure of staff costs, one solution that was supported by a majority (75%) of the respondents was to have payroll tax relief.

To date, the Government of Canada has offered a temporary wage subsidy of 10% on wages. A number of companies have highlighted this is not enough to get them through this period. Potential to scale this payroll subsidy by company size (higher percentage for smaller companies) would benefit these companies.

“The main thing is that we keep our employees engaged and not lay them off . We need to be ready to ramp up when the time comes. I hate to think we could lose trained employees. I would like help keeping them employed..”

Finance is the top concern of more than half the companies and impacts HR, Technology R&D, Sales and Operations a number of respondents shared the sentiment in the comment box to increase liquidity in the market as soon as possible. This is also echoed in the CEO Cleantech Alliance open letter, with signatures from 200+ CEOs in the industry.

“Depending on the length of the outbreak, increases to IRAP payments, new grants, or early SRED payments could all be helpful. Since our ability to sell is limited right now, financial support is going to be necessary to maintain employment if this goes on for a long period of time. Loans are something to consider, but we are not really interested in taking on debt to remain operational given that we don't know how quickly the economy will recover.”

“I'll be speaking with our financial institution tomorrow to see if they have access to emergency funds that we're not aware of at this time. It's unlikely that our Association can respond in the timeframe that would help our company. As such, our probability of success in making it to the summer is < 50% at this time.”

“The #1 need is company liquidity to bridge this period of slow revenue and/or collapse of the planned financing options. Action around debt, funding programs and grants can be summarized by faster processing times, increasing eligible project amounts and pre-payment of gov. payments. Debt prepayment holidays are helpful but quite limited in impact for urgent company liquidity needs.”

“Continue SRED and create liquidity in market by enhancing existing programs”

“EDC and BDC's response to COVID to date are inadequate. We need EDC to move beyond their standard 75% EGP support to up to 100% to get liquidity flowing to CT companies. We need BDC to move off underwriting to whether a company would have qualified for financing pre-Covid to support businesses with solid fundamentals that have been interrupted from their next fundraise or landing new sales due to COVID.”

There is an overwhelming need for fast action and simplified processes:

“Speed”; “Quick Action”; FASTER”; ….we need it FAST”

Sales Impact

A number of respondents (37%) expressed they are either expecting delays to their supply chain which impacts their sales cycle, meaning cash flow is a problem. Canada’s cleantech companies are at a high risk of losing market share in light of COVID-19 given the majority of them are exporting ($7.8 billion worth of exports) either to the US, Europe and Asia.

“We expect delays from suppliers in providing materials, and in delays from customers in purchasing and payments. We are just starting to make sales. We have reduced burn rate already but will need $30,000 per month for at least 3 months.”

Company X had a “Q1 sales goal of $1 million, this has now been reduced by 75%”.

“As potential clients deal with COVID, there are significant delays in closing sales and engagements. Assistance with identifying and contacts with organizations that are moving forward with business would be helpful.”

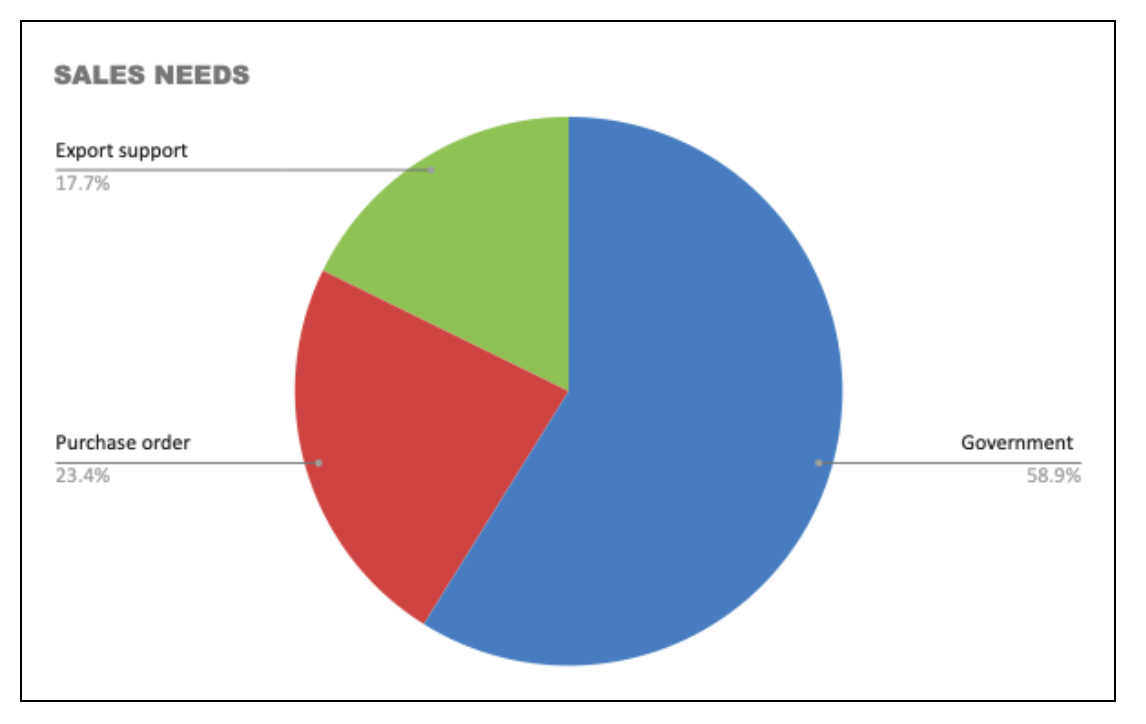

To help the companies overcome sales challenges, the majority (over 58%) have requested support for government purchasing of cleantech solutions and for additional support with Purchase Order Financing and Export support. Existing entities such as EDC and the Trade Commissioner Service help with international PO financing. 17% of companies say they need export support to get them through this period.

Given the slowdown in exports there is a very large gap on the domestic side for government purchasing and purchase order support. This could be a really strategic time for Canada and the government to support adoption and procurement of cleantech solutions domestically and create local supply chains.

As one company suggested there is an opportunity to ‘direct the federal funds to be a multiplier: adding jobs, manufacturing industry, creates more local supply chains and reduce greenhouse gases.’

“Implement a small business set-aside procurement program very similar to the ones in the United States whereby a significant percentage of all government agency (including Defence) procurements are solely open to majority CANADIAN-owned small businesses.”

Operational Impact

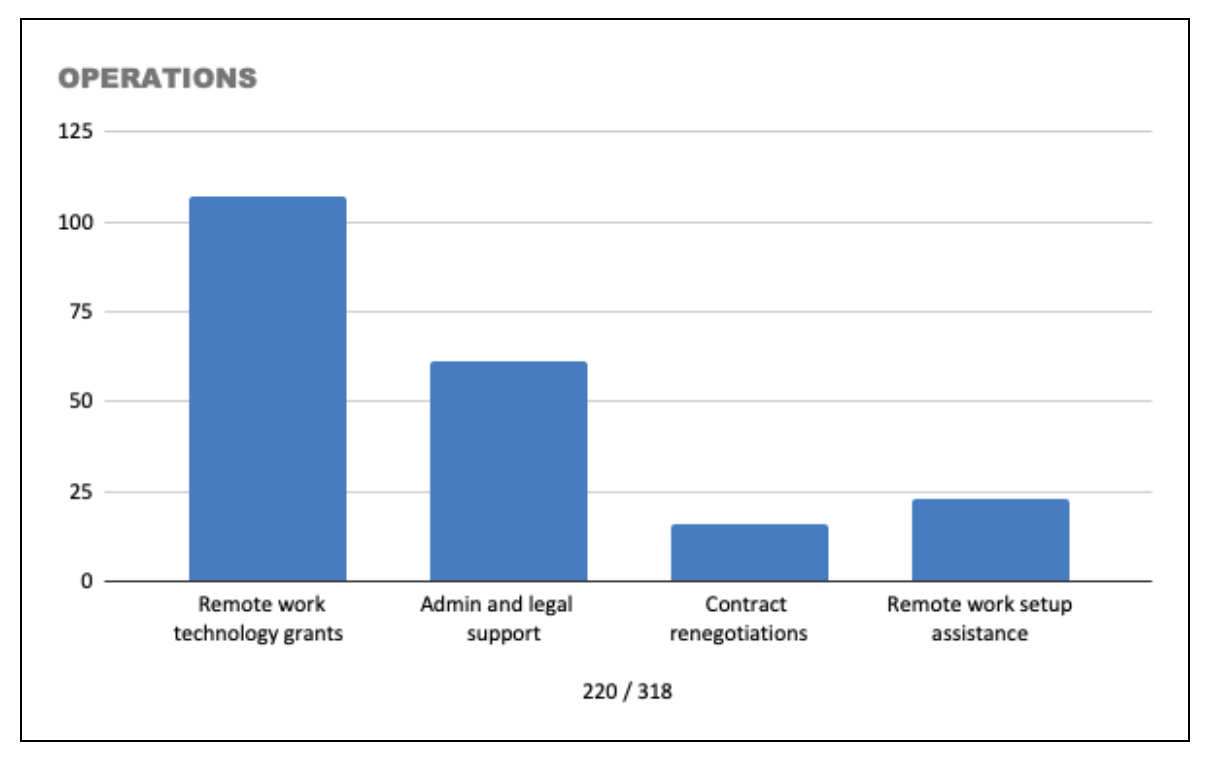

Due to COVID-19, a fundamental shift has changed in how we work. Given that most staff are now working from home, a majority of the companies expressed interest in remote technology grants to help their teams set-up at home offices with the right equipment.

A number of companies in the cleantech sector are early stage hardware companies requiring labs and access to technical facilities to validate technology. These companies either have to put a halt to their technology development and lose the opportunity to utilize ongoing R&D grants or find a way to adapt their environment.

"Company XX is currently awaiting launch of our lab space, postponed from our initial launch date of March 15, 2020. At present, Company XX has a 3-month runway, which supports our lab costs and employee salaries. Until the lab is opened, our employees will be awaiting their first paycheque, and applying for EI in Alberta. Company XX is unable to continue development of our manufacturing method, and fulfill customer contracts, until the lab is re-opened after the COVID crisis has passed."

"Employee protection remains critical. We thank the Government for the measures taken to date, and request they extend EI to those who have to self-isolate but cannot work from home (e.g. plant operators or lab techs)."

To ensure there are adequate safe and healthy measures being taken at home as teams work on hardware development, availability of remote work tech grants would be helpful for companies during this interim period.

There is also an increasing need for admin and legal support to help companies navigate. We anticipate this will focus on grant writing for emergency funds as well as legal discussions with customers and banks.

“Help to keep our company's cash flow positive so that we can progress our projects and pay our staff. Assistance with accessing resources, applying for grants and accessing customers.”

R&D Impact

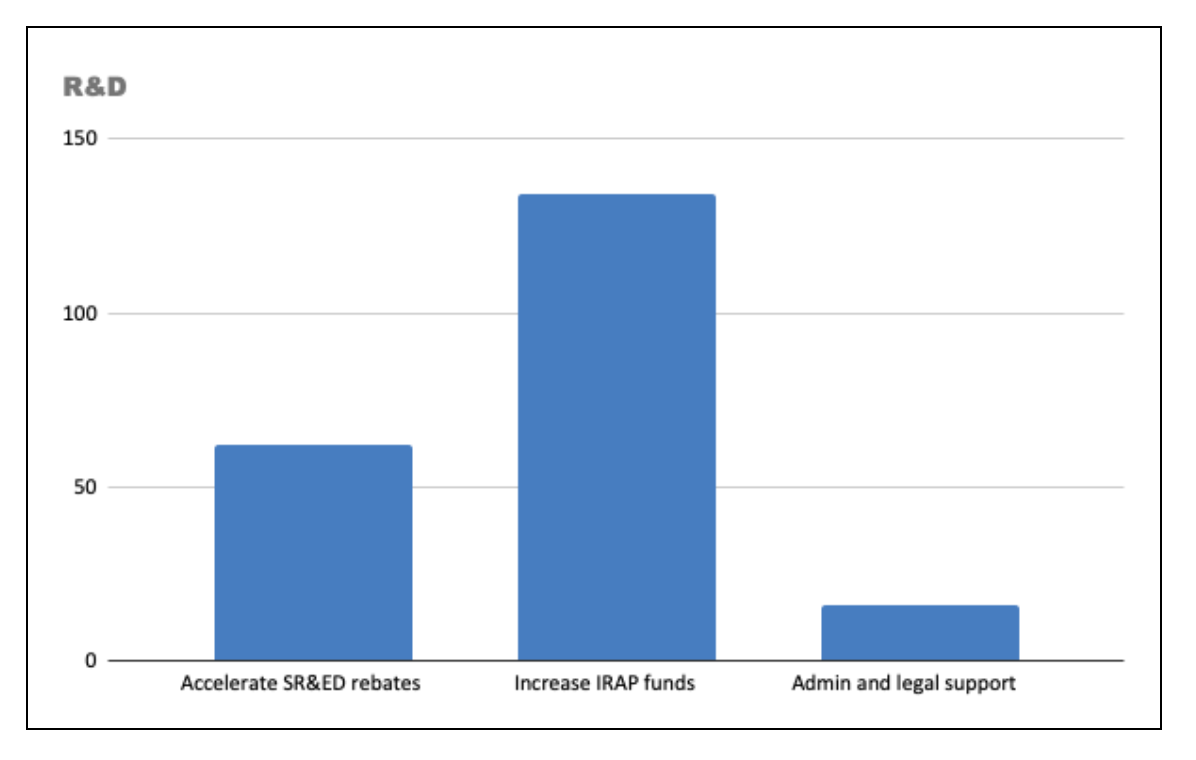

The majority of companies (63%) would like to see more NRC-IRAP financing to support their R&D technology efforts. Given the importance of SR&ED, (29%) want to see accelerated SR&ED rebates to ensure there is continued liquidity. This matches with responses that companies need capital in the near-term to cover costs.

In a separate question on the survey, a total of 94 companies made a request to waive or extend grant funding obligations. This number has grown significantly since last week. It was suggested in the comment boxes to provide additional ‘emergency’ funds, pre fund instead of reimburse for existing grants or contributions, have an opportunity to rescope deliverables and timeline or reduce matching obligation. Here are a couple of comments from companies about this:

“Our company is involved in a number of funding programs (SDTC & BC ICE) which are dependent on certain milestones heavily influenced by our suppliers and ability to do 3rd party testing which is significantly disrupted right now. Leeway to release funds on an existing timeline while milestones are still being completed is most critical for Company XXX. For upcoming milestones, prefunding (rather than reimbursement) would be very helpful. We are required to continue supplier and manufacturing work and pay for it, but are unable to push work with our customers or in testing and validation so our biggest need is for cash to cover these significant stagnant periods.”

“Temporarily lifting the 75% stacking limit so that funding groups could increase their funding - Removing the 10% holdback and spread it across earlier milestone payments - Weight the milestone payments differently so that it shifts cash forward to earl”

“Please waive the recently implemented $500,000 minimum sales requirement for IRAP; this is such a project killer for science based startups because we cannot generate sales until after we have done the actual product development.”

Conclusions

The #1 need is liquidity to bridge this period of slow revenue and/or collapse of the planned financing options. Prefunding is preferred over reimbursement given the sudden nature of the liquidity challenges being experienced.

This is best delivered by expediting existing funding pipelines using SRED and NRC-IRAP, replacing lost private sector liquidity by giving direct grants, zero or low interest loans and by delaying government finances such as deferring payroll taxes and increasing payroll subsidies.

10% is not enough. In interviews with companies it was expressed that a one-time grant of $250 - 300,000 would see them through 4 months. For larger firms more would be required. Stacking rules need to be waived. Access to capital through BDC and EDC working with commercial banks needs to be made less restrictive and more flexible to be impactful in the cleantech sector.

In addition to that, cashflow is a major problem. Having buyers for technology was highlighted as essential. Government could take on a stronger role for procuring and purchasing cleantech or creating incentives for domestic industry to purchase, especially during this period when export markets are tight.

This survey results represents a significant subsection of the industry and is an indication of the scale of the problem. We hope these insights will continue to be taken into account.

Next Steps

The Government of Canada is doing a commendable job in announcing funding and emergency packages for industry. We hope this data will be used to inform the direction of a cleantech-focused economic recovery.

What’s critical is that information, programming and funding responses continue to be broadcast to these companies and the uptake is completed relatively quickly to ensure the companies stay afloat.

Contact:

| JEANETTE JACKSON | JACOB MALTHOUSE | JASON SWITZER | MAIKE ALTHAUS |

|---|---|---|---|

| Foresight Cleantech Accelerator | Canada Cleantech Alliance | ACTia | OCTIA |

| BARNABE GEIS | KIERAN HANLEY | JENNIFER TUCK | DENIS LECLERC |

| Centre for Social Innovation | NEIA | The Maritimes Energy Association | Ecotech Quebec |