The Alberta Cleantech Report 2021, based on research conducted by Foresight Alberta and MaRS Data Catalyst in 2020, provides a snapshot of Alberta cleantech including employment, sectors, customer groups, and founders.

- Size of the sector remains constant: We identified over 210 pureplay cleantech SMEs in Alberta; 72 responded to the survey. This is a slight decrease in qualified responses since our 2019 report (78) and unchanged from 2017.

- Employment is expected to grow: Responding cleantech SMEs employed 625 people in Alberta in 2020. Most (85%) expect to hire new employees, an estimated 1,200 new staff in 2021.

- Urban areas dominate: Nearly 80% of responding ventures are located in and around Calgary , and 20% are located in Edmonton and surrounding areas.

- Sector is maturing: although nearly half of responding companies were under 5 years old, there are fewer new (less than 2 years old) cleantech ventures in 2021 compared to 2017 and 2019. More are in a growth phase, 2-10 years old, where Technology Readiness Level (TRL) is higher.

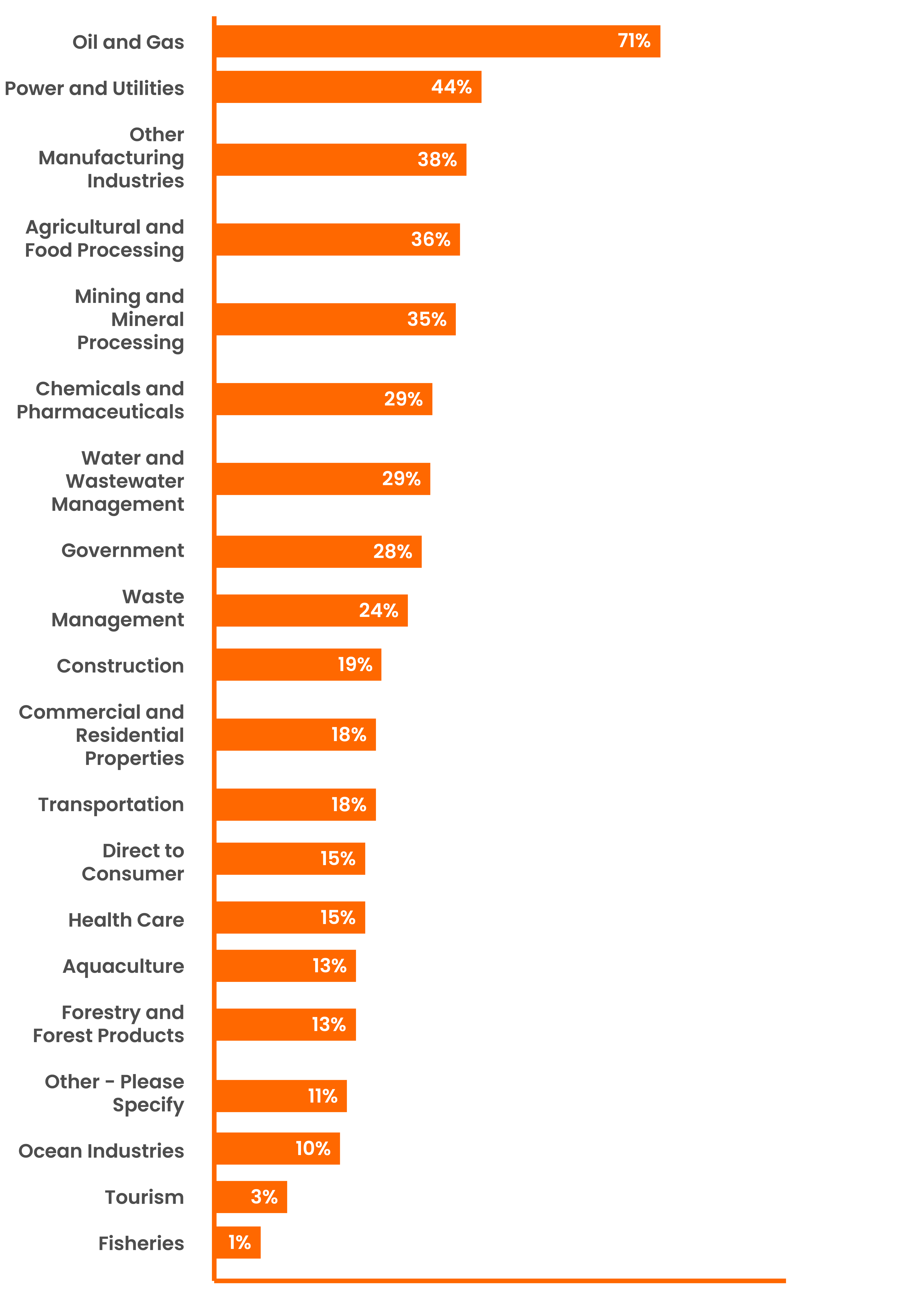

- Energy industry dominates customer markets: Nearly three-quarters of Alberta cleantech companies seek to sell to the oil and gas industry. Nearly half seek customers in power and utilities, and about one-third in either “other manufacturing”, the agricultural sector, or mining.

Alberta Cleantech Customers and Target Markets

Energy and carbon focus: While cleantech in Alberta spans a broad range of industrial sectors, SMEs report a focus on energy efficiency and renewables, with a particularly large group focused on Carbon Capture, Utilisation and Storage. The top 5 subsectors are:

- Energy efficiency (22%)

- Digitization (14%)

- Renewable energy production and storage (13%)

- Sustainable fuel development (13%)

- CCUS (8%)

Greenhouse gas (GHG) emissions reduction is most common environmental benefit: 58% of cleantech ventures identify reducing GHGs as their primary environmental benefit, followed by water (12%) and resource management and efficiency/recovery (9%).

Who is Leading Alberta Cleantech Ventures?

- Half of Alberta cleantech ventures (51%) are led by first-time founders

- 32% of ventures have a founder with a trades background

- About one-quarter of ventures (28%) have founders who were born outside Canada.

- 22% of ventures have a female founder, which is above the national average of 15.6% and consistent with the wider Alberta tech sector

Jump to the next section:

1. Introduction | 2. The State of Cleantech in Alberta | 3. Funding & Growth | 4. Challenges & Risks | 5. Seizing the Cleantech Opportunity

We gratefully acknowledge our partners, Canada West Foundation, Delphi Group, and MaRS Discovery District, for their contributions to this report.