The BC Cleantech Cluster Initiative, in partnership with FP Innovations and the BC Pulp & Paper Bio-Alliance hosted a roundtable with a number of leaders and innovators in the bio-products sector.

The event was held at the FP Innovations boardroom at UBC Campus on Nov 26, 2019.

The roundtable opened with a presentation from the BC Pulp & Paper Bio-Alliance giving an overview of the BC Bio-products market and presenting their ideas and research on what it would take to build a world-leading advanced bio-products cluster in BC.

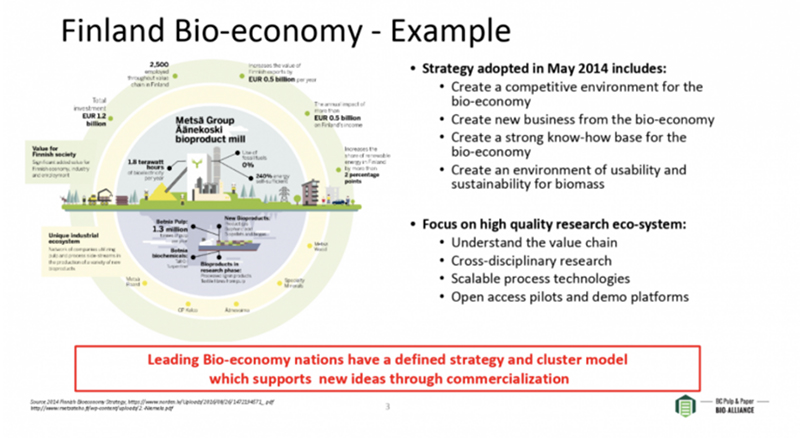

The presentation opened with two key examples and resources for the group to consider and to frame the discussion. First, the BioEconomy model adapted by Finland in 2014:

The Finland Bio-economy model is working because they have a defined strategy and cluster model that focused on the entire value chain and used the principles of a circular economy.

The second resource that set the stage for the discussion was the Forest Bioeconomy Framework for Canada that was published in 2018 by the Canadian Council of Forest Ministers.

Canada’s bioproducts sector is undergoing a transformation - more than $720 million has been invested in the sector since 2012:

- $200 Million - Biofuels

- $200 Milion - Biomaterials

- $200 Million - Engineered Wood

- $120 Million - Biochemicals

What are the Strengths of this Industry in BC?

(Photo credit: Vancouver Fraser Port Authority)

Overall, there was agreement that BC has a great deal of economic and regional strengths that could position the province to develop a world-leading bioproducts economy:

- High Quality and Sustainable fibre supply

- Industry infrastructure - Pulp & Paper, Forest sector, end users

- Integration of forestry, solid wood and pulp industry

- Synergies with mining, construction, agriculture, etc.

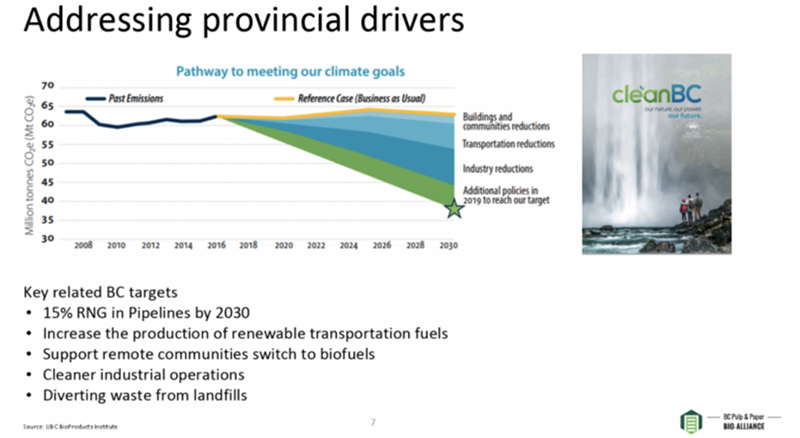

- CleanBC GHG reduction targets

- Ideally suited for creation of regional centres

- Access to Pacific Rim markets & Cascadia

- Access to the “Cascadia Corridor”

- Deep sea ports

- Skilled workforce and HQP development

- World-class innovation organizations, academia, research centres

What Needs to Happen for this Industry to Thrive?

The Finnish bioeconomy model was brought up again as the discussion moved toward what needs to happen for the industry to thrive. Like Finland, we are a small economy compared to other global players, so it is going to be crucial to take a big picture, collaborative approach and involve the entire (and complicated) value chain across the province. Expanding the consultation process and involving remote and Indigenous communities will be very important as the discussion around building a bioproducts cluster continues.

The customer piece is also critical - while we will need customers at home to get started, we will also need to have an export market for the bioproducts we produce (especially, for example, bio-chemicals and plastic replacements, etc). We will need outreach, export market development programs and partnership models to accelerate this and develop international markets beyond who we are currently selling to.

The need for investment was also discussed. What has the potential to make money and would be the biggest return on investment? Mills and infrastructure across the province are aging and will require re-investment, and bioproducts should be a large part of developing the business models for funding/investment of facilities and new projects.

Feedstock supply was also a discussion topic. From forest biomass to mill waste (ash, sludge) or manure, there is a need to ensure supply issues for bioproducts and the bioeconomy are understood. Feedstock supply, and how it is collected, distributed and used must be part of the economic analysis moving forward.

Next Steps: Market Development and Opportunities

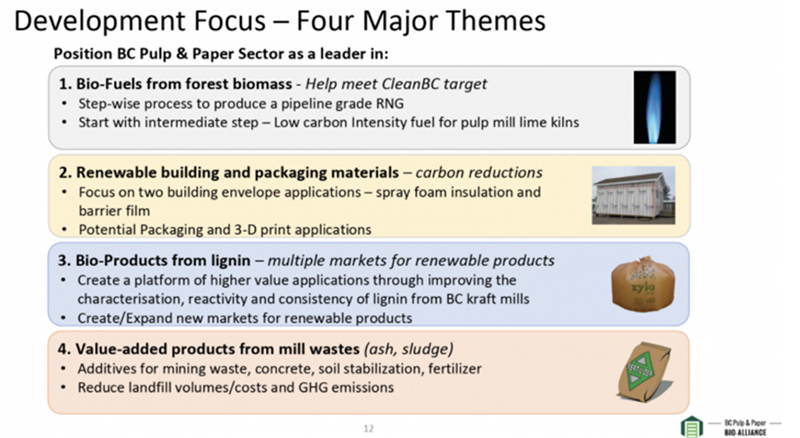

The opportunity for BC Bioproducts are large-scale and wide ranging. Discussion focused on four major themes outlined by the BC Pulp & Paper BioAlliance:

- Biofuels from forest biomass - help meet CleanBC target

- Renewable building and packaging materials - carbon reduction

- Bioproducts from lignin - multiple markets

- Value-added products from mill wastes (ash, sludge)

The world is moving towards a circular economy and developing an advanced bioproducts economy was seen as a major solution provider for meeting the CleanBC targets. The challenge and opportunity facing us is to add the most value possible to our declining fibre supply and to diversify and grow the forestry industry so it can support sustainable businesses and rural communities.

Along with our biomass resources, sector expertise, skilled workforce and shipping-friendly location, we have world-class R&D capabilities at UBC, FP Innovations, UNBC, other academic institutions. We also have regional specialities and forestry/cleantech related clusters of economic activity (e.g. Prince George, Squamish).

BC can be a leader in advanced bio-products if we leverage these strengths and share a common strategy that fosters innovation and collaboration. While there are ambitious targets set out for them, and important issues driving this emerging economy (see below), there should be more government incentives to produce biofuels and encourage the use of bio-based products.

Government strategy should develop in concert with the Bio-Products Cluster, and should include a bio-energy/biofuels strategy. Government should be part of accelerating the innovation and development process from R&D/early innovation through to commercialization, especially de-risking stages (lab to pilot and scale-up to commercial).The importance of strategic thinking and collaboration was a key discussion point, as while the industry is being developed, and a secure and economically viable fibre feedstock supply is being established, there is a need to keep companies, jobs, and the supply chain functioning.