Canada and CCUS: A Brief History

Canada is one of the world leaders in CCUS, with five out of 30 global CCUS projects. We have sequestered 1/7th of globally captured CO2 at 50+ Mt, and have 10 new mega projects announced covering over $1B in investment in CCUS.

The continued interest in CCUS and requests for collaboration from the global community are clear indicators that Canada has the knowledge and expertise to scale this industry to net zero by 2050.

What are the CCUS Tax Credits?

The Canadian government announced Budget 2023, which included generous tax credits for Carbon Capture, Utilization, and Storage (the CCUS Tax Credit). These refundable tax credits include capital investment through 2031 and cover three project types:

- 60 per cent for investment in equipment to capture CO2 in Direct Air Capture (DAC) projects

- 50 per cent for investment in equipment to capture CO2 in all other CCUS projects

- 37.5 per cent for investment in equipment for transportation and storage

The new credit incentives will allow Canadian innovators to deploy projects as quickly as possible. The value of the credits is reduced by half between 2031 and 2040, and fully phased out beyond 2040. The anticipated outcome of these credits is to develop and deploy Canadian CCUS projects and create a competitive environment for projects up against the lucrative US Inflation Reduction Act.

Another interesting aspect of the program is that knowledge sharing is required for very large projects valued at $250M or greater over their lifetime. Each of these projects is required to create a public report to detail the commissioning and first five years of the project. The goal of this report is to provide lessons learned in CCUS deployment for other project owners to learn from, and if projects do not complete the report, they’ll face penalties.

What are the limitations?

To be eligible, projects must be planned to operate for a minimum of 20 years and provide more than 10 per cent eligible CO2 use in every year. This is important because it encourages the development of high-quality projects and limits the risk for these investments.

Currently, the recovery mechanism ensures that the investment tax credit (ITC) is provided to “eligible use” cases — and these cases only account for permanent geologic storage and storage in concrete. This really limits the “U” in CCUS, which is always the most difficult problem to solve on the carbon value chain. Are there opportunities to promote high-quality projects without limiting innovators?

What does this mean for Canadian project developers?

These tax credits are great news for Canadian project developers, and we are already seeing the announcement of projects since the budget was released. These credits provide a massive opportunity to make CCUS more feasible for industry by reducing capital expenses by up to 60 per cent.

What does this mean for Canadian innovators?

These tax credits provide a great opportunity for project developers to deploy projects in Canada but they do not protect the use of Canadian tech within these projects. There is a risk to Canadian tech developers that their tech may be outcompeted by US or global tech developers looking to deploy in a more lucrative market.

Climate change is a problem without borders, but Canadian cleantech innovators often struggle to deploy their solutions in the Canadian market. Ensuring that made-in-Canada technologies get a first look could help innovators who face challenges with domestic adoption.

What is the US Inflation Reduction Act?

The US Inflation Reduction Act (IRA) was announced and has had sweeping impacts across the country — some have credited it as a green revolution for the US. It is a bill that introduced large-scale changes to many sectors of the US economy, and has made some major changes to CCUS and the 45Q tax credit while providing easier access to capital for projects and processes that reduce carbon emissions.

The changes to 45Q increase the dollars per tonne of carbon capture in different use cases as well as lowering the requirements for facilities to qualify for these tax credits. This means more facilities are able to access funding to deploy technologies and projects and reduce their CO2 emissions. It’s a major win for industry and tech developers who can now reduce risks associated with deploying novel technologies.

How do the ITCs compare to the US Inflation Reduction Act?

The function of these credits are inherently different but aim to achieve the same outcome — less carbon in our atmosphere.

Canadian tax credits:

- Capital costs for project deployment

- For projects that operate for 20 or more years

- Focused on geologic sequestration or use in concrete storage

US IRA tax credits:

- Increase the dollar per tonne of carbon capture

- Only available for direct refunds for five years and then create a credit marketplace for the following seven years for corporates to buy and sell credits

Closing Thoughts

Carbon capture is required to limit global warming to 1.5°C in all scenarios, and we are encouraged to see that Canada is providing opportunities for project developers to deploy projects faster and at the scale required for climate change.

The credits are open to public consultation until September 8.

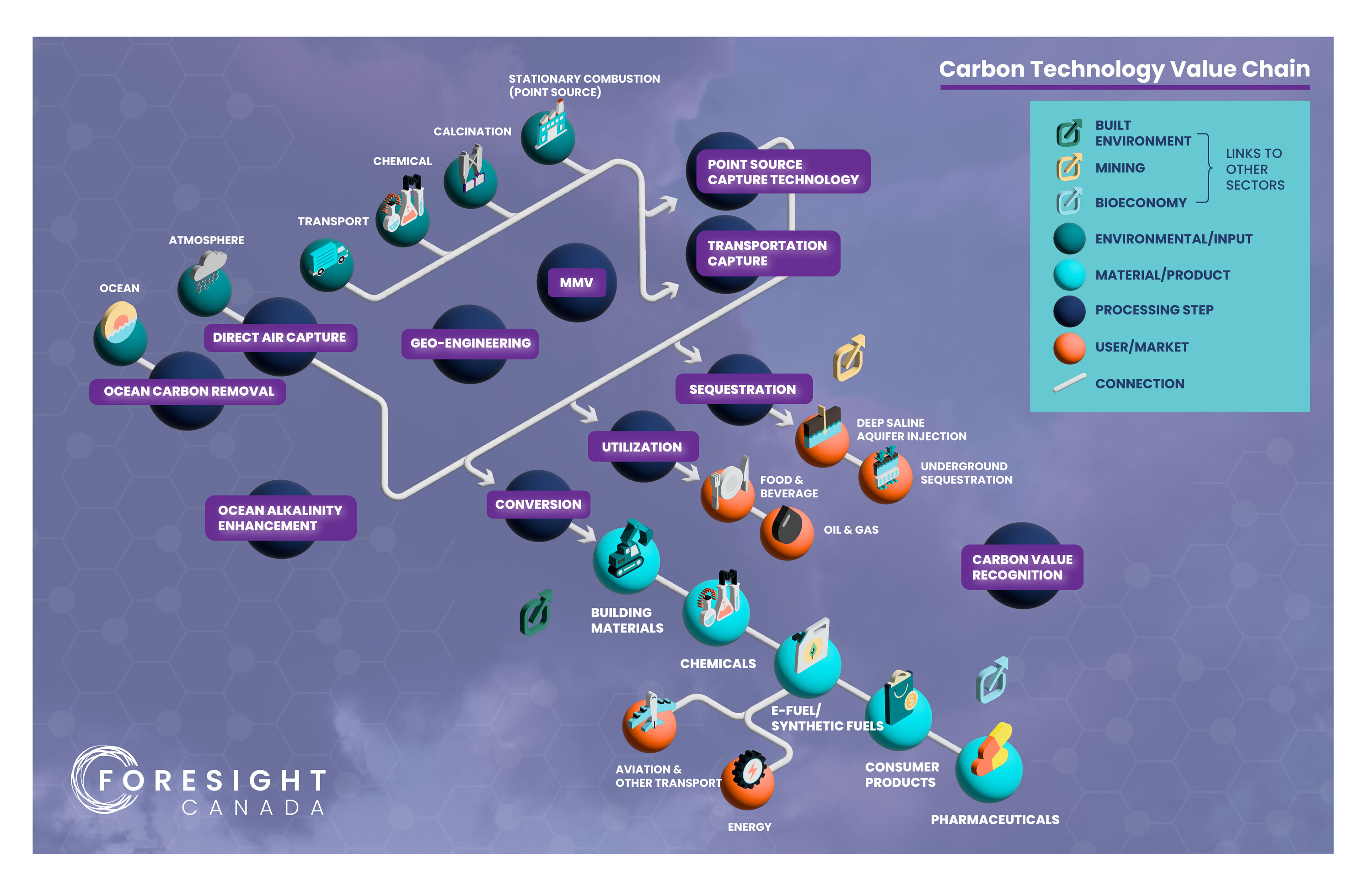

The Canadian CCUS value chain is complex and full of opportunities for industry and innovators. Understanding Canada’s carbon tech strengths, gaps, and key opportunities to grow the sector is instrumental in paving the way for new technologies to emerge and to advance technology deployment as we seek to reduce emissions.

Foresight Canada’s Ventures to Value Chains: Carbon Technology’ is part of a Foresight initiative that leverages data from technology companies and other key stakeholders to map, categorize, and analyze strategically important industry value chains for Canada in the clean economy.

Interested in learning more? Check out Canada’s Carbon Tech Value Chain.

Resources:

- The IRA and CCUS Development Explained

- Tax Insights: Finance releases draft legislation for the clean technology and CCUS investment tax credits

This article was written by the team at carbonNEXT